Editor’s Note: This material is for informational purposes only. Any information or viewpoints expressed should not be construed as an obligation to purchase any financial instruments or investments.

Do you have a friend who would love to see this?

Finding a great stock is difficult. Even portfolio managers (professional stock pickers) often struggle with finding great stocks to purchase. It's not a perfect science, but there are some very helpful strategies. One secret to remaining disciplined and consistently finding great investments is to analyze stocks in specific sectors or industries that you are interested in!

In today's blog, I will discuss a specific sector that I am particularly bullish on and then we'll talk about some specific stocks in that industry. As always, I will give my buy/sell recommendations on each stock.

During my sophomore year in college, my sociology teacher, Professor Suarez, made a bet with me that I couldn't give up meat for two weeks. As a confident and slightly stubborn 19-year-old, I took her up on her offer. Fast forward nearly 10 years later and I've been a practicing pescetarian ever since, even though the majority of my diet is vegetarian.

These days, most menus have easy entree swaps or totally vegan options, but it was rough those first few years. I learned to cook for myself and stumbled into the world of fake meats! Today, meat alternatives are one of the fastest-growing food categories. So without further ado, let's talk how to make money buying fake meat stocks!

image via Morning Brew

Can you name five vegan/vegetarian stocks? Hard right? Here are my top 5 (last to first):

*Feel free to click on the hyperlink to see the current price of the stock

5) CAG*- Comment below if you are on a flexitarian diet—someone who is not necessarily a vegetarian but often substitutes meat with more plant-based products. You might be familiar with Conagra from their iconic brands: Hunt's, Slim Jim, Reddi-wip, and PAM products, but it is their Gardein product line that has investors salivating (see what I did there?). Gardein is one of my favorite plant-based meat alternatives lines, particularly because it's available at all of the big-box retailers and is very affordable. Over the last four years, the brand has quadrupled in size! That's a lot of faux nuggets right? Market analysts predict the fastest-growing segment in food is vegan "meats"...guess which brand is the market leader? Yep, you guessed it!

4) BYND- Beyond Meat is probably the most recognizable meatless company. They have secured partnerships with Dunkin' Brands, KFC, and Subway. The stock became public last year for $25, and is now $150—a growth rate of 64%, and a slew of partnerships can certainly do that. The reason why BYND is not higher on this list is that this is a very high price for the stock for an investor to get in at. However, if the company can successfully integrate its products to the Chinese market and/or land a big order from a massive fast-food chain (ex. McDonald's) this stock may rocket to $300 🚀. I am personally waiting on a pull-back to purchase it but if you really want a hyper-growth stock in an under-penetrated market this stock is for you.

3) FMCI- Cauliflower pizza anyone? Tattooed Chef, anewly formed merger with Forum Merger II, has carved a niche in the cauliflower boom. They have cauliflower pizza, cauliflower mac & cheese, and an assortment of other products. Although I've never tried any of their products, I love what I'm seeing. The company is relatively cheap (compared to BYND), demonstrates high growth (currently in Costco, Trader Joe's and Walmart), and the food has great reviews. It's only a matter of time until Domino's, Pizza Hut, or Papa John's partners with them to take cauliflower pizza nationwide (they owned the patent for a cauliflower crust). I am a current investor and urge you to take a look as well.

Image via Tattooedchef.com

2) AMZN- Okay okay, I know I kind of cheated by putting Amazon on this list. Amazon has its hands in virtually everything. Amazon is the best public company in the world, I can't help myself 😔😂). When Amazon purchased Whole Foods for $13.7B they were essentially saying, "We want to be in the healthy food category!" Whole Foods (along with private Trader Joe's) are still the leaders in the fake meat category. If you want in on the fake meat industry, you can always buy Amazon.

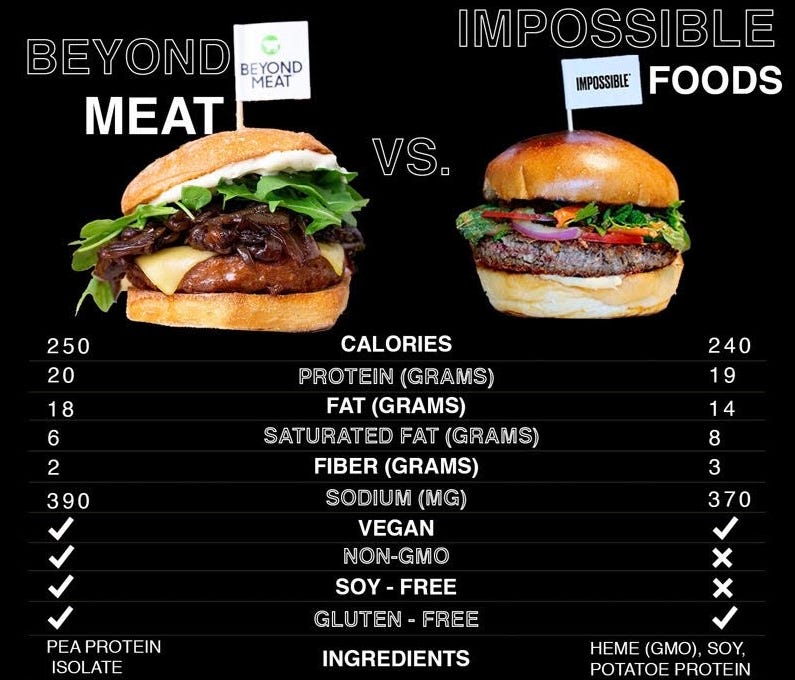

1) Impossible Foods- Impossible Foods is not yet public, so why did I include it as my favorite fake meat stock? The CEO recently announced that they will be looking to go public very soon (like this year). My guess is that COVID-19 has only accelerated this timeframe because of the supply chain disruptions in the meat supply. In any event, whenever this company announces it's going public, mark it on your calendar and invest immediately! As you can see on the chart below, there is not much difference between the flagship product of Impossible Food and Beyond Meats. The big difference is in stock price. If you missed the boat for Beyond Meat, get on board for Impossible Food's IPO (probably around $40). If you read this blog and you don't buy Impossible Foods, I will be very mad at you (I'm serious 💔).

image via screenshot

Notable mention:

TSN- You may know Tyson because they are the largest meat producer in America but they also have a new and fast-growing plant-based meat alternative brand, "Raised and Rooted." Besides the lackluster name, I am not sure how committed company executives will be to grow the non-meat category since they make 99% of their revenue from meat products. But I am also an investor in Tyson Foods because the stock is historically cheap.

K: Kellogg's owns the popular MorningStar Farms brand. If MorningStar was its own separate entity I would highly recommend this stock, but my issue with Kellogg's is that I don't see as much growth potential in their other brands, namely the cereals and snacks; their existing plant-based meat category is the only thing I like about this stock. Unfortunately, that isn't enough to warrant a favorable recommendation from me.